January 2024 Newsletter

HAPPY NEW YEAR!

WISHING YOU ALL A

HAPPY & HEALTHY 2024!

Let's kick off 2024 with enthusiasm and positivity! The past year may have had its challenges, but together, we've weathered storms and celebrated victories. Now, let's embrace the clean slate that the New Year brings, ready to script another chapter of success, growth, and joy.

We wish you all a year filled with happiness and love!

Our Best!

-Lisa & Dylan

2024 Home Paint Colors

The trendsetting colors of 2024 have arrived, captivating us with a palette dominated by soothing earth tones, deep moody hues, and a spectrum of blues.

This year's color forecast emphasizes nature-inspired tones, featuring terra-cotta and forest-inspired greens alongside a range of coastal blues, from light pastels to bold teals. As we bid adieu to the bold colors of 2023, the hues of 2024 are already inspiring our upcoming renovation projects.

Mortgage Rates Can

Continue To Decline In

2024

The Federal Reserve's efforts to control inflation by raising the Federal Funds Rate have slowed down, indicating a positive outlook on the economy. As inflation cools, the Fed's rate hikes have become less frequent. The recent decision to keep interest rates unchanged and forecast potential future cuts suggests an improving economic landscape. This development could lead to lower mortgage rates and enhanced affordability for homebuyers. While mortgage rates may remain somewhat volatile, the overall trend, supported by expert forecasts, indicates a potential continued decline in 2024. Understanding these dynamics is crucial for those planning to buy a home, and seeking expert advice can help navigate these market changes effectively.

What You Need to Know

About Saving For a Home

In 2024

Planning to buy a home can be less daunting when you understand the essential costs involved, and seeking guidance from trusted real estate professionals is crucial. While saving for a down payment is a priority, it's a misconception that 20% is mandatory. Partnering with experts helps explore various loan types and down payment assistance programs tailored to your situation. Additionally, budgeting for closing costs, ranging from 2 to 5 percent of the mortgage, is vital. Consider saving for an earnest money deposit (EMD), typically 1-2% of the home price, showcasing commitment to the seller. Consulting with a real estate advisor ensures informed decisions, making your home buying journey smoother. Connect with us for expert guidance throughout the process.

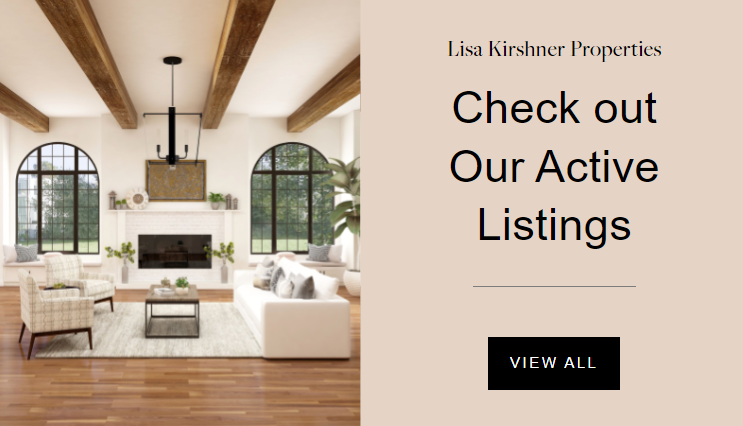

Work With Us

We care about each client's experience as if it is our own. That is the LKP team motto, which holds true. We represent people, not properties.

Lisa Kirshner Properties commitment to our clients’ success has made us a top 10 team in West Los Angeles!

Newsletter

We will get back to you as soon as possible.

Please try again later.

Lisa Kirshner DRE# 01159728 | Dylan Elkin DRE# 01965657

Office Locations

Los Angeles

11911 San Vicente Blvd Suite 390,

Los Angeles, CA 90049

San Francisco

All Rights Reserved | Lisa Kirshner Properties

Real Estate Web Design by Bullsai